Many people have their own investment portfolio these days, and even those who don’t may receive shares as part of their work bonuses in the future. While there are many savvy investors who go it alone, there are times when we could all benefit from a little advice. A sole investor simply won’t have access to the same high-tech data and analysis as the professionals, and it is important to know when to seek specialised advice.

Risk

Do you know how much risk you can afford to take on? Ascertaining your

risk appetite should be the starting point for any would-be investor. This does not just refer to your personal attitude towards risk – somepeople are naturally more wary than others.

It is largely your personal circumstances that should dictate your tolerance for risk. To determine this, you will need to take many factors into account, such as proximity to retirement and any other financial commitments you may have. If you are not sure how much you can afford to invest, or whether you should be making high- or low-risk investments, then you will need to seek the advice of an independent financial adviser.

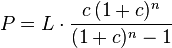

Risk analysis and management is a complicated business. Teams of mathematicians work constantly to build new algorithms to enable risk to be measured and quantified. This data is used by professional asset managers to make informed decisions about which assets to allocate to their portfolios. It would be impossible for a novice investor to take into account all of the varied risks that can be simulated by professional risk management software.

Visit APT to learn more and see the huge range of analytics available to professional asset managers.

Asset allocation

Once you have determined your risk appetite, you are ready to start allocating assets to your portfolio. There are numerous online resources available that provide data and investment advice, many of which are free. Financial websites such as

MarketWatch.com will keep you updated on business and economic news and provide a huge amount of information about stock, bond and commodities markets worldwide. However, if you are feeling a little lost, which is understandable with the amount of different products out there, you should seek professional investment advice.

One way to benefit from professional asset management is to invest in a fund. Your capital will be pooled with that of other fund members and the money will be invested in accordance with the stated aims of the fund. You can select a fund that invests in a particular class of assets or geographical area or other criteria –thechoice is yours.

Performance analysis and portfolio optimisation

While you can track the performance of your assets, without the benefit of professional market analysis and forecasts you will always be reactive rather than proactive. Professional asset managers continually analyse the market and try to predict any fluctuations that may affect assets under their management.

Multi-factormodelling is a sophisticated tool used by the professionals, which enables them to forecast the effect of many different factors on a particular market. For example,you may want to forecast the effect of exchange rate fluctuations and a change of government on bonds in a particular country.

While there is some excellent free investment advice out there, it can be quite generalised, and you should always seek advice from the professionals if you do not understand your investments. They will tailor their advice to your specific requirements and financial situation, and help you make the most of your investments.